Build Strategy Portfolio

One moment please.

Important information about these statistics

These return calculations (and corresponding maximum-drawdown statistic) are estimates.

These calculations assume that your portfolio starting-capital amount will be .

Notice that this starting amount of is different than the starting capital shown on the details page for the strategy called . Thus, the return percentage shown here is different than the return percentage shown on the strategy page.

The percentage shown here may be slightly different that the percentage show on the strategy page for the strategy called , due to mathematical rounding and web-browser-based optimization.

It's important to remember that trading is very risky. All results shown here are hypothetical, based on simulated trading, and thus have inherent limitations. Most people who trade lose money.

|

(About this)

|

Worst drawdown

|

Total Monthly Subscription

|

Remember: trading is risky. Most traders lose money. These results are based on simulated or hypothetical performance results that have certain inherent limitations. ( Learn more. )

About the results you see on this Web site

Past results are not necessarily indicative of future results.

These results are based on simulated or hypothetical performance results. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

You may be interested to learn more technical details about how Collective2 calculates the hypothetical results you see on this web site.

Trading is risky

There is a substantial risk of loss in futures and forex trading. Online trading of stocks and options is extremely risky. Assume you will lose money. Don't trade with money you cannot afford to lose.

Name your portfolio

First choose a name for your portfolio. For now, only you will see it.

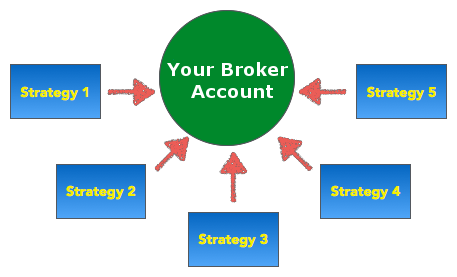

Build a portfolio of trading strategies

Collective2 gives you access to thousands of trading strategies. You can mix these strategies together to create a portfolio of strategies.

Choose from over 95,000 strategies

We evaluate thousands of strategies. They are created by traders, computer programmers, and market analysts around the world. Here are just a few:

How Collective2 is different than most "alternative" investment methods

- The money stays in your brokerage account, in your name.

- You never write a check to anyone.

- You never pay any 1% management fee to us.

- You never pay any percentage of profits to us.

- Instead, you pay a flat monthly fee for each strategy you blend into your portfolio. Fees typically are between $50 and $150 dollars each month.

- Most strategies offer free trial periods.

Risks

Of course there are risks you need to be aware of.

- You're running the show. You decide which strategies to use, and how big to trade. You need to keep an eye on your account. No one is doing it for you.

- Trading is risky. You can lose all your money. Only do this with money you can afford to lose.

Use any broker

You don't need a special brokerage account. If you have an account at one of the brokers below, you can start trading immediately. (If not, you can open an account pretty easily.)

Or you can use our free "simulated broker account" to test it out.

C2Broker

StoneX Futures

StoneX

Israel Interactive Trading

Oanda

C2 Paper Trading

LevelX

T3 Trading

Interactive Brokers

C2 Gateway

Tradovate

MB Trading

IBKR Europe

OptionsHouse

Infinity Futures

FXCM

Gain Capital

OpenECry

Daniels Trading

RCG

NinjaTrader Brokerage

AMP Clearing

CQG

Rithmic

AutoShares

CTS T4

Optimus Futures

High Ridge Futures

TradersOnly

BeTrader

Quantum

Fox Group

Halifax

AGN Futures

Stage5

Jitneytrade

Dorman Trading

Trade Pro Futures

Capital 19

Phillip Capital

DAW Trading

Gar Wood Securities

Israel Interactive

Tradier

IG

EOption

Infinox

Under development

Add your first strategy

Click on one of the strategies below.

Add one more

You probably want to have at least two strategies in your portfolio.

Go ahead and click one more.

Add more strategies, or continue

You can add as many strategies as you like.

When you are done, click here.

Since this is your personalized portfolio, you decide how much capital to invest.

We recommend leaving this value at $25,000, at least to start.

Reminder: Do we need to tell you that trading is risky? Well, it is. You can lose money trading. You should only use money you can afford to lose.